|

|

|

Chapter 6:

Cost Accounting |

Contents:

Chapter 6: Cost Accounting

6.1 Accounting for Manufacturing

Operations

6.2 Product Costs vs. Period Costs

6.3 Product Costs and the Matching

Principle

6.4 Cash Effects

6.5 Inventories of a Manufacturing

Business

6.6

You as the Chief

Financial Officer

6.7

The Need for "Per

Unit Cost Data"

6.8

Determining the Cost

of Finished Goods Manufactured

6.9

Financial Statements

of a Manufacturing Company

|

|

|

|

|

6.1

Accounting for Manufacturing Operations

|

6.1 Accounting

for Manufacturing Operations

A

Merchandising company buys its inventory in a ready-to-sell

condition. Therefore,

its cost of goods is mostly composed of the purchase price

of the products it sells. A manufacturing company, however,

produces the goods that it sells. As a consequence, its cost

of goods sold consists of various manufacturing costs,

including the cost of materials, wages earned by production

workers and a variety of other costs relating to the

operation of a production facility.

Manufacturing

operations are an

excellent example of how managerial and financial accounting

overlaps because manufacturing costs are of vital importance

to both financial and managerial accountants also rely on

prompt and reliable information about manufacturing costs to

help answer such questions as:

What sales

price must we charge for our products to earn a reasonable

profit?

Is it possible

to lower the cost of producing a particular product line in

order to be more prices competitive?

Is it less

expensive to buy certain parts used in our products than to

manufacture these parts ourselves?

Should we

automate our production process with a robotic assembly

line?

|

|

Classifications of Manufacturing Costs

Direct materials

Direct labor

Manufacturing overhead |

6.1.1 Classifications of Manufacturing Costs

A typical

manufacturing company purchases raw materials and converts

these materials into finished goods through the process of

production. The conversion from raw materials to finished

goods results from utilizing a combination of labor and

machinery. Thus manufacturing costs are often divided into

three broad categories:

(a) Direct materials the raw

materials and component parts used in production whose costs

are directly traceable to the products manufactured.

(b) Direct labor - Wages and

other payroll costs of employees whose efforts are directly

traceable to the products they manufacture, either by hand

or with machinery.

(c) Manufacturing overhead a

catch all classification, which includes all manufacturing

costs other than the costs of direct materials and direct

labor.

Examples include factory utilities,

supervisor salaries, equipment repairs and depreciation on

machinery.

Note that

manufacturing costs are not immediately recorded as current

period expenses. Rather.

They are costs of creating inventory and they remain on the

balance sheet until the inventory is sold. For this reason

manufacturing costs are often calls product costs (or

inventorial costs).

|

|

6.2

Product Costs

vs. Period Costs

Operating expenses

Distinction between product and period costs

|

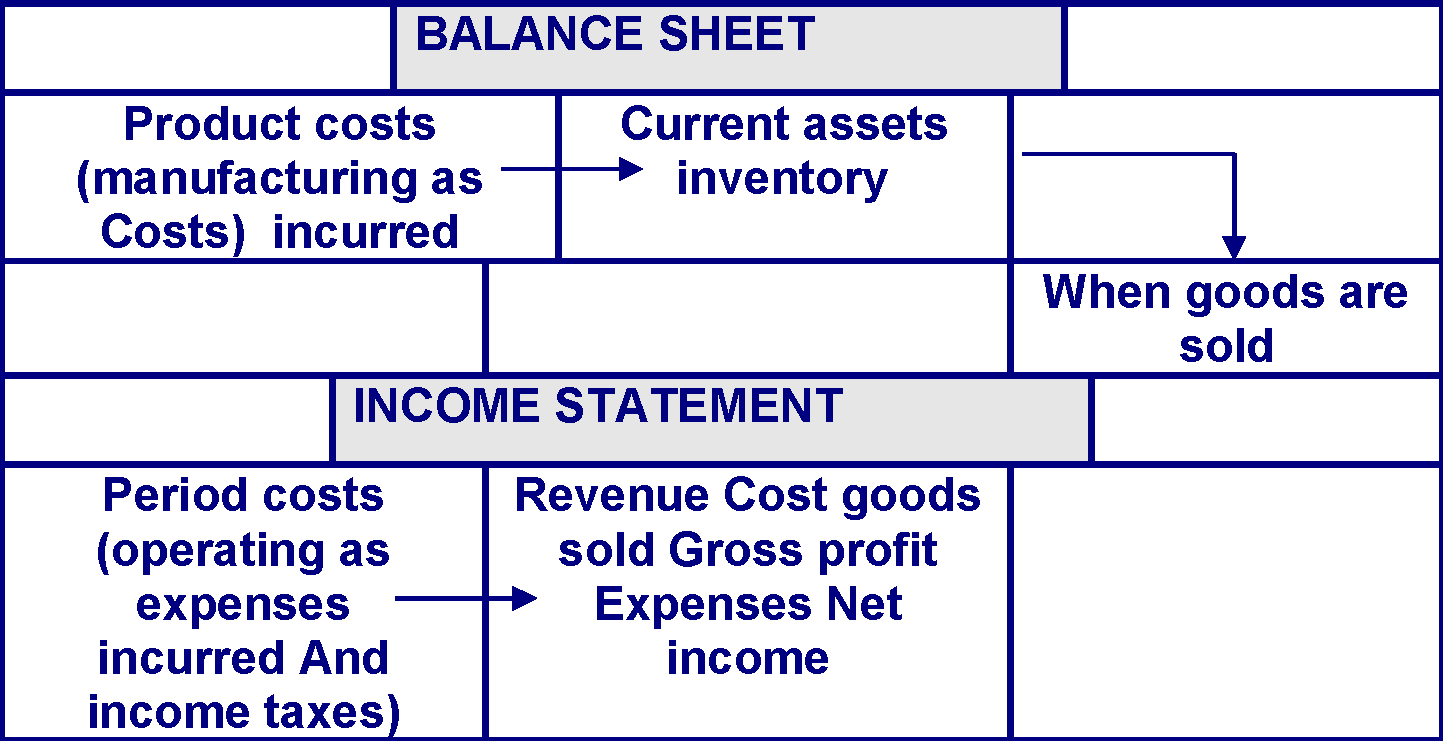

6.2 Product

Costs vs. Period Costs

The terms

product costs and a period costs are helpful in explaining

the difference between manufacturing costs and operating

expenses. In a

manufacturing environment, product costs are those costs

incurred to manufacture inventory. Thus, until the related

goods are sold, Product costs represent inventory. As such,

they are reported on the balance sheet as an asset. When the

goods are ultimately sold, product costs are transferred

from the balance sheet to the income statement. Where they

are deducted from revenue as the cost of goods sold

Operating

expenses that are

associated with time period, rater than with the production

of inventory, are referred to as period costs. Period costs

are charged directly to expense accounts on the assumption

that their benefit is recognized entirely in the period when

the cost is incurred. Period costs include all selling

expense, general and administrative expenses, interest

expense, and income tax expense. In short period costs are

classified on the income statement separately from cost of

goods sold. As deductions from a company's gross profit.

The flow of

product costs and period costs through the financial

statements is shown in the diagram below.

To further

illustrate of the distinction between product and period

costs, consider two costs that, on the surface, appear

quite similar: the depreciation of a warehouse used to store

raw materials versus depreciation of a warehouse used to

store finished goods. Depreciation of the raw materials

warehouse is considered a product cost (a component of

manufacturing overhead) because the building is part of the

manufacturing process. Once the manufacturing process is

complete and the finished goods are available fro sale all

costs associated with their storage are considered selling

expenses. Thus the depreciation of the finished goods

warehouse is a period cost.

|

|

6.3

Product Costs and the Matching

Principle

Example

|

6.3 Product

Costs and the Matching Principle

Underlying

the distinction between product costs and period costs

is familiar accounting concept the matching principled. In

short, Product costs should be reported on the income

statement only when they can be matched against product

revenue, to illustrate see Table 6.1:

Table 6.1: Product costs

Consider a

real estate developer who stats a tract of 10 homes in May

of the current year,

during the year, the developer incurs material, labor, and

overhead cost amounting to $ 1 million ( assume $ 100,000

per house ) . By the end of December, none of the houses has

been sold. How much of the $1 million in construction costs

should appear on the developer's income statement for the

current year?

The

answer is none. These costs are not related to any revenue

earned by the developer during the current year.

Instead, they are related to future revenues the developer

will earn when the houses are eventually sold. Therefore, at

the end of the current year, the $ 1 million of product

costs should appear in the developer's balance sheet as

inventory. As each house is sold $ 100,000 will be

deducted from sales revenue as cost of goods sold. This way,

the developer's income statements in future period will

properly match sales revenue with the cost of each sale.

|

|

6.4

Cash Effects

|

6.4 Cash Effects

Classifying costs as

period or product costs can have significant cash

effects when the classification determines in what period

the cost appears on the income statement as an expense.

Using the real estate developer example above, assume the $1

million in construction cost was classified as a period

expense rather than a product expense. The current period's

net income would be substantially reduced by the additional

$1 million in expenses and the cash flow associated with the

current year's income taxes would be significantly

reduced.

|

|

6.5

Inventories of a Manufacturing

Business

In many countries

|

6.5 Inventories

of a Manufacturing Business

In the

preceding example,

assume all 10 houses were completed by the end of the year;

in this case the developer's inventory consists only of

finished goods. Most manufacturing companies, however

typically account for three of inventory.

Materials

inventory raw

materials on hand and available for use in the manufacturing

process.

Work

in process inventory

partiality completed good on which production activities

have been started but not yet completed.

Finished

good inventory unsold

finished products available for sale to customers. All three

of these inventories are classified on the balance sheet as

current assets. The cost of the materials inventory is based

on its purchase price. The work in process and finished

goods inventories are based on the costs of direct martial.

Direct labor and manufacturing overhead assigned to them.

In

many countries such as Argentina and Greece, inventory

valuation does not conform to the lower of cost or market

value rules used in the united stated.

In addition, many countries, including Brazil, Korea,

Mexico Nigeria, Poland, and Taiwan allow upward revaluation

of property and equipment; these differences in

accounting methods make comparing inventory values of

companies from different parts of the world very difficult.

Manufacturing

companies may use either

a perpetual or a periodic inventory system. Perpetual

systems have many advantages, however, such as providing

managers with up to date information about the amounts of

inventory on hand and the per unit costs of manufacturing

products. For these reasons, virtually all large

manufacturing companies use perpetually inventory systems.

Also the flow of manufacturing costs through the inventory

accounts and into the cost of goods sold is most easily

illustrated in a perpetual inventory system. Therefore, we

will assume the use of a perpetual inventory system, in our

discussion of manufacturing activities.

|

|

6.6

You as the Chief

Financial Officer

|

6.6

You as the Chief

Financial Officer

Assume that you are

the chief financial officer of Conquest, Inc., and that you

have just received an income statement and balance sheet from

plant accountant Jim Sway in Bend, Oregon. In your

conversations with Jim you learn that in the recent reporting

period, plant manager Darien Cocky asked that inventory

transportation cost, the cost of repairing the plant parking

lot, and the newly installed plant landscaping costs all be

allocated to the cost of production. In addition, when these

allocations took place, the plant produced many more bicycles

than were sold creating significant increased in the amount of

inventory on hand. As a result, most of the costs described by

Jim have been assigned to the inventory,) (included as part of

inventory costs on the balance sheet), but have not been

assigned to cost of goods sold expenses (Included on the income

statement).

|

|

6.7

The Need for "Per

Unit Cost Data" |

6.7

The Need for "Per

Unit Cost Data"

Transferring the

cost of specific units from one account to another requires

knowledge of each unit's per unit cost

that is the total manufacturing costs assigned to specific

units. The determination of unit cost is one for the primary

goals of every cost accounting system.

Unit

costs are of importance to both financial and management

accountings. Financial

accountants use unit costs in recording the transfer of

completed goods from work in process to finished goods and from

finished goods to cost of goods sold management accountants use

the same information to make pricing decisions. Evaluate the

efficiency current operations, and plan for future operations.

|

|

6.8

Determining the Cost

of Finished Goods Manufactured

|

6.8

Determining the Cost

of Finished Goods Manufactured

Most

manufacturing companies prepare a schedule of the cost of

finished gods manufactured to provide mangers with an overview

of manufacturing activities during the period.

Schedule of Summit cost of finished goods manufactured is shown

in Table 6.2.

|

Summit Inc.

Schedule of the cost of finished goods manufactured

For the year ended December 31, 2004 |

|

Work in process

inventory , beginning of the year |

|

$ 30,000 |

|

Manufacturing cost

assigned to production |

|

|

|

Direct materials used

|

$150.000 |

|

|

Direct labor

|

$300,000 |

|

|

Manufacturing overhead |

$360,000 |

|

|

Total manufacturing

costs |

|

$810.000 |

|

Total cost of all work

in process during the year |

|

$840,000 |

|

Les : work in process

inventory end of the year |

|

(40,000) |

|

Cost of finished goods

manufactured |

|

$800.000 |

A schedule of the

cost of finished goods manufactured is not a formal financial

statement and generally does not appear in the company's annual

report. Rather, it is

intended primarily to assist mangers in understanding and

evaluating the overall cost of manufacturing products by

comparing these schedules for successive periods, for example,

managers can determine whether direct labor or manufacturing

overheads is rising or falling as a percentage of total

manufacturing costs. In addition, the schedule is helpful in

developing information about unit costs.

If a company

manufactures only single product line, its cost per unit simply

equals its cost, if finished goods manufactured divided by the

number of units produced. For example if Summit produces only

one line of mountain bike, its average cost per unit would be

$80 had it produced 10,000 finished units during 202 ($800,000

divided by 10.000 units) If conquest produced multiple lines of

mountain bikes, it would prepare a separate schedule of the cost

of finished goods manufactured for each product line.

|

|

6.9

Financial Statements

of a Manufacturing Company |

6.9

Financial Statements

of a Manufacturing Company

Let us now

illustrate how the information used in our example will be

reported in the 2004 income statement and balance sheet of

Summit Inc. The company's

2004 income statement is presented in Table 6.3:

Table 6.3:

Income statement of

Summit Inc.

|

Summit Inc.

Income statement

For the year ended December 31, 2004 |

|

Sales |

|

$1,300,000 |

|

Cost of goods sold |

|

$ 782,000 |

|

Gross profit on sales

|

|

$ 518,000 |

|

Operating expenses

|

|

|

|

Selling expenses

|

$135,000 |

|

|

General and

administrative expenses |

$265,000 |

|

|

Total operating expenses |

|

$400,000 |

|

Income from operations

|

|

$ 18,000 |

|

Less : interest expense

|

|

$ 18,000 |

|

Income before income e

taxes |

|

$ 30,000 |

|

Net income

|

|

$ 70.000 |

Notice that no

manufacturing costs appear among the companys operating

expenses. In fact,

manufacturing costs appear in only two places in a

manufacturer's financial statements. Costs associated with units

sold during the period appear in the income statement as the

cost of goods sold. The $782,000 cost of goods sold figure

reported in Summit's income statement was taken directly forms

the company's perpetual inventory records. However, this amount

may be verified as shown in Table 6.4:

Table 6.4: Income

statement

|

Beginning finished goods

inventory (1/1/04) |

|

$150,000 |

|

Add: cost of finished

goods manufactured during the year

|

|

$800,000 |

|

Cost of finished goods

available for sate |

|

$950,000 |

|

Less : Ending finished

goods inventory (12/31/04) |

|

$168,000 |

|

Cost of goods sold

|

|

$782,000 |

|

Summit Inc.

Partial balance sheet (December 31,

2004) |

|

Current assets : |

|

|

|

Cash and cash

equivalents |

|

$60,000 |

|

Accounts receivable (

net of allowance for doubtful accounts

|

|

$190,000 |

|

Inventories : |

|

|

|

Materials

|

$20,000 |

|

| | | |

Stress Management(6)

Stress Management(6)