|

6.3 Least Squares Method

We

estimate the parameters

and and

in

a way similar to the methods used to estimate all the other

parameters discussed in this notes. We draw a random sample from

the populations of interest and calculate the sample statistics

we need. Because in

a way similar to the methods used to estimate all the other

parameters discussed in this notes. We draw a random sample from

the populations of interest and calculate the sample statistics

we need. Because  and and

represent

the coefficients of a straight line, their estimators are based

on drawing a straight line through the sample data. To see

how this is done, consider the following simple example. represent

the coefficients of a straight line, their estimators are based

on drawing a straight line through the sample data. To see

how this is done, consider the following simple example.

Example (4)

Given the following six observations of variables x and

y,-determine the straight line that fits these data.

|

x |

2 |

4 |

8 |

10 |

13 |

16 |

|

y |

2 |

7 |

25 |

26 |

38 |

50 |

Solution:

As a

first step we graph the data, as shown in the figure. Recall

that this graph is called a scatter diagram. The scatter diagram

usually reveals whether or not a straight line model fits the

data reasonably well. Evidently, in this case a linear model is

justified. Our task is to draw the straight line that provides

the best possible fit.

Scatter Diagram for Example

We

can define what we mean by best in various ways. For example, we

can draw the line that minimizes the sum of the differences

between the line and the points. Because some of the differences

will be positive (points above the line), and others will be

negative (points below the line), a canceling effect might

produce a straight line that does not fit the data at all. To

eliminate the positive and negative differences, we will draw

the line that minimizes the sum of squared differences. That is,

we want to determine the line that minimizes.

Where yi represents the observed value of y and

represents

the value of y calculated from the equation of the line. That

is, represents

the value of y calculated from the equation of the line. That

is,

The

technique that produces this line is called the least squares

method.

The line itself is called the least squares line, or

the regression line. The "hats" on the coefficients

remind us that they are estimators of the parameters

and and

. .

By

using calculus, we can produce formulas for

and and

.Although

we are sure that you are keenly interested in the calculus

derivation of the formulas, we will not provide that, because we

promised to keep the mathematics to a minimum. Instead, we offer

the following, which were derived by calculus. .Although

we are sure that you are keenly interested in the calculus

derivation of the formulas, we will not provide that, because we

promised to keep the mathematics to a minimum. Instead, we offer

the following, which were derived by calculus.

Calculation of  and and

. .

where

and

where

The

formula for SSx should look familiar; it is the

numerator in the calculation of sample variance s2.

We introduced the SS notation; it stands for sum of squares.

The statistic SSx is the sum of squared differences

between the observations of x and their mean. Strictly speaking,

SSxy is not a sum of squares.

The

formula for SSxy may be familiar; it is the

numerator in the calculation for covariance and the coefficient

of correlation.

Calculating the statistics manually in any realistic Example is

extremely time consuming. Naturally, we recommend the use of

statistical software to produce the statistics we need. However,

it may be worthwhile to manually perform the calculations for

several small-sample problems. Such efforts may provide you with

insights into the working of regression analysis. To that end we

provide shortcut formulas for the various statistics that are

computed in this chapter.

Shortcut Formulas for SSx and SSxy

As

you can see, to estimate the regression coefficients by hand,

we need to determine the following summations.

Sum

of x:

Sum

of y:

Sum

of x-squared:

Sum

of x times y:

Returning to our Example we find

Using these summations in our shortcut formulas, we find

and

Finally, we calculate

and

Thus, the least squares line is

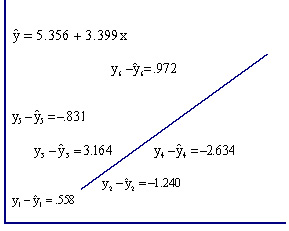

The

next figure describes the regression line. As you can see, the

line fits the data quite well. We can measure how well by

computing the value of the minimized sum of squared differences.

The differences between the points and the line are called

residuals, denoted ri . That is,

The

residuals are the observed values of the error variable.

Consequently, the minimized sum of squared

differences is called the sum of squares for error denoted

SSE.

Sum

of Squares for Error

The

calculation of SSE  this

Example is shown in the next figure. Notice that we compute

Yi by substituting Xi into the formula for the regression line.

The residuals are the differences between the observed values this

Example is shown in the next figure. Notice that we compute

Yi by substituting Xi into the formula for the regression line.

The residuals are the differences between the observed values

and

the computed values and

the computed values .

The following Table describes the calculation of SSE. .

The following Table describes the calculation of SSE.

|

|

|

|

|

RESIDUAL |

RESIDUAL SQUARED |

|

|

|

|

|

|

|

|

1

2

3

4

5

6 |

2

4

8

10

13

16 |

2

7

25

26

38

50 |

1.442

8.240

21.836

28.634

38.831

49.028 |

0.558

-1.240

3.164

-2.634

-0.831

0.972 |

0.3114

1.5376

10.0109

6.9380

0.6906

0.9448 |

|

|

|

|

|

|

Thus, SSE = 20.4332. No other straight line will produce a sum

of squared errors as small as 20.4332. In that sense, the

regression line fits the data best. The sum of squares for error

is an important statistic because it is the basis for other

statistics that assess how well the linear model fits the data.

Example (5)

We

now apply the technique to a more practical problem.

Example (6)

Car

dealers across North America use the "Red Book" to help them

determine the value of used cars that their customers trade in

when purchasing new cars. The book, which is published monthly,

lists the trade-in values for all basic models of cars. It

provides alternative values of each car model according to its

condition and optional features. The values are determined on

the basis of the average paid at recent used-car auctions.

(These auctions are the source of supply for many used-car

dealers.) However, the Red Book does not indicate the value

determined by the odometer reading, despite the fact that a

critical factor for used – car buyers is how far the car has

been driven. To examine this issue, a used-car dealer randomly

selected 100 three year of Ford Taurusses that were sold at

auction during the past month. Each car was in top condition and

equipped with automatic transmission, AM/FM cassette tape

player, and air conditioning. The dealer recorded the price and

the number of miles on the odometer. These data are summarized

below. The dealer wants to find the regression line.

Solution:

Notice that the problem objective is to analyze the relationship

between two quantitative variables. Because we want to know how

the odometer reading affects selling price, we identify the

former as the independent variable, which we used, and

the latter as the dependent variable, which we label y.

Solution by Hand:

To

determine the coefficient estimates, we must compute SSx

and SSxy. They are

and

Using the sums of squares, we find the slope coefficient.

To

determine the intercept, we need to find x and y.

They are

and

Thus,

The

sample regression line is

Interpreting The

Coefficient

The

coefficient  which

means that for each additional mile on the odometer, the price

decreases by an average of $0.0312 (3.12 cents). which

means that for each additional mile on the odometer, the price

decreases by an average of $0.0312 (3.12 cents).

The

intercept is .

Technically, the intercept is the point at which the

regression line and the y-axis intersect. This means that

when x = 0 (i.e., the car was not driven at all) the selling

price is $6,533. We might be tempted to interpret this number as

the price of cars that have not been driven. However, in this

case, the intercept is probably meaningless. Because our sample

did not include any cars with zero miles on the odometer we have

no basis for interpreting .

Technically, the intercept is the point at which the

regression line and the y-axis intersect. This means that

when x = 0 (i.e., the car was not driven at all) the selling

price is $6,533. We might be tempted to interpret this number as

the price of cars that have not been driven. However, in this

case, the intercept is probably meaningless. Because our sample

did not include any cars with zero miles on the odometer we have

no basis for interpreting .

As a general rule, we cannot determine the value of y for a

value of x that is far outside the range of the sample values of

x. In this example, the smallest and largest values of x are

19,057 and 49,223, respectively. Because x = 0 is not in this

interval we cannot safely interpret the value of 11 when

x = o. .

As a general rule, we cannot determine the value of y for a

value of x that is far outside the range of the sample values of

x. In this example, the smallest and largest values of x are

19,057 and 49,223, respectively. Because x = 0 is not in this

interval we cannot safely interpret the value of 11 when

x = o. |